If each of you has the children for at least 35% of overnights per year (shared custody), you should use Worksheet B. Only the noncustodial parent (parent without primary custody) will pay support-courts presume that the custodial parent's share is already going toward the direct costs of raising children. Under the primary parent calculation, the total amount of support is divided between the parents based on their percentage shares of income, without any adjustment for parenting time.

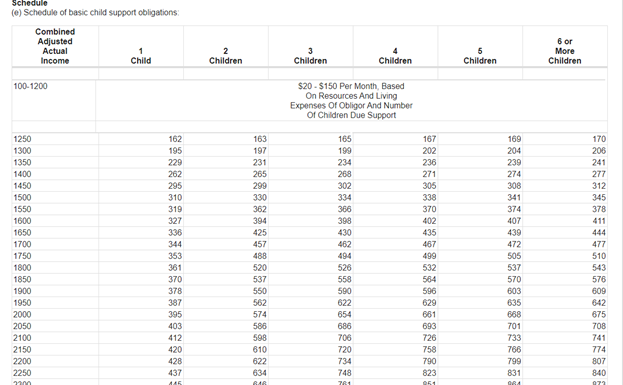

If you and your child's other parent have a parenting arrangement where one of you has primary physical custody and the other has court-ordered visitation amounting to less than 35% of overnights per year, you should use Worksheet A. You can also try using Maryland's Department of Human Services child support calculator, but keep in mind that the calculator won't take into account any adjustments for parenting time or other unusual situations Parenting Time in Maryland-Choosing Worksheet A or B If you're having trouble with the forms and calculations, contact an attorney for help. Ultimately, a judge will order a child support amount only if it's in the child's best interests. Navigating through the materials on your own can be quite challenging. In most cases, you can estimate how much child support a court would be likely to order in your case by downloading and completing a Financial Statement Form DR 30 and a Child Support Guidelines Worksheet either Worksheet A-Primary Physical Custody Form DR 34 or Worksheet B-Shared Physical Custody Form DR 35. The Family Law section of the Maryland Courts website provides forms and instructions for parents handling their own child support case. In Maryland, custody and visitation arrangements, alimony awards, and child support orders from previous relationships can impact support amounts. Multiple steps are required to obtain an accurate child support figure, and the guidelines are fairly complex. A percentage of the total support obligation is assigned to each parent based on that parent's income percentage.įor example, if parent A earns $6,000 per month and parent B earns $4,000 per month, parent A would be responsible for 60% of the support amount (6,000 divided by 10,000) and parent B for 40% of the support amount (4,000 divided by 10,000). Maryland's child support guidelines allow parents to calculate their support obligation by inputting their combined incomes and the number of children they have together. In other words, each parent will be assigned a support amount under the Income Shares Model based on his or her income. Maryland follows the "Income Shares Model," which estimates the amount of money parents spend on their children while the family lives in the same household-called "combined adjusted actual income." This amount is divided between the parents based on earnings. In Maryland, both parents, whether married or not, are obligated to support their children. If you're a parent going through a divorce, or if you have never been married to your child's other parent and are ending the relationship, you may need information about child support.

0 kommentar(er)

0 kommentar(er)